Lately, Zelle® scams have been on the rise — particularly on Facebook Marketplace. Because Zelle® is a money-exchanging platform that essentially functions the same as handing someone cash, tracking fraud after the fact — and getting reimbursed for the lost funds — are both really challenging. Plus, accountability for these fraudulent transactions is murky, since banks are typically only responsible for unauthorized payments — not if you willingly wire someone money. It goes without saying that getting scammed is both a frustrating and upsetting experience for a multitude of reasons. Of course, hindsight is 20/20, and it can be easy to spot what red flags were missed after the fact. To help prevent fraud and stay vigilant, we compiled a list of tips and resources to help you spot these scammers from the start and keep your money, personal identity, and privacy safe. Read on to learn more about how to protect yourself from Facebook Marketplace and Zelle® scams.

Facebook Marketplace Scams: An Example

Online shopping is the new way of life, and social media has completely altered the online shopping landscape. As much as social media-related shopping platforms like Facebook Marketplace have revolutionized online shopping for the better, they’ve also centralized scammers to these platforms — so intensely, in fact, that Facebook + Instagram alone accounted for 90% of shopping scams last year.

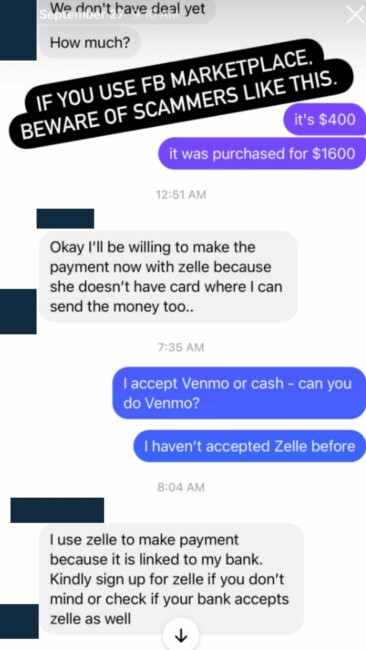

There are many ways these scammers go about tricking victims (like encouraging communication off Facebook, trying to get payment upfront, listing fake/phony ads, and more) — but a common one is to request a Zelle® payment. With its quick transfer of money and unclear accountability for fraud (more on that later), it makes it a great breeding ground for scammers.

Here’s an example of what a scammer might try to do:

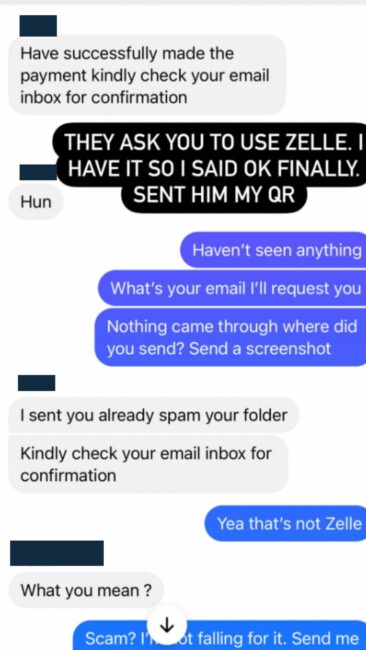

In the above screenshot, the scammer was adamant about using Zelle® even to make a payment — not just receive one.

Of course, any third-party payment and wiring can be risky, including Venmo and Cash App. These apps exchange money almost instantly and can be really difficult to trace and recoup lost funds. According to Reader’s Digest, “Facebook’s Purchase Protection policies only cover payments made through Facebook Checkout, so there is no guarantee you will get your money back if you pay with another method.” While scams can happen on any of these apps, Zelle® scams in particular have become increasingly popular.

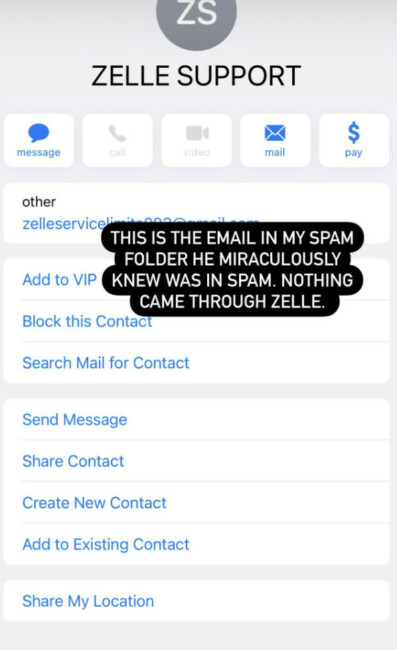

The scammer seemed to somehow know the payment would’ve gone to spam. Nothing actually came through Zelle®, and the aforementioned ‘payment email’ was posing as an email from ‘Zelle® Support.’

When this user called out the sketchy email and let the scammer know they were reporting it, the scammer immediately left the chat — which was a pretty clear admission of guilt.

Read More: This Vizsla, Corgi Mix, + More Pups are Looking for North Jersey Homes

This is just one scam experience from Facebook Marketplace, but in general, if it feels off — it probably is. Click here to learn more about other Facebook Marketplace scams you may find out there.

Zelle® Scams

Zelle® scams in particular have been on the rise — and accountability for the fraud is murky. Banks are only required to recoup ‘unauthorized transactions,’ which are often not the case when it comes to scams that involved the victim willingly wiring money.

However, it’s best for everyone when scams are avoided — and some banks have been submitting tips and guidance for catching and preventing fraud in the first place. The following tips are courtesy of one such bank, PNC, and were sent in an email broadcast.

Payment Scam Red Flags

There are a few common payment scam red flags to look out for:

- Sometimes, scammers impersonate employees of your bank to let you know there’s been suspicious activity on your account. They do this by asking you to Zelle® a payment to yourself — when in actuality, you’d be sending the payment to the scammer.

- Scammers can pretend to be Microsoft or Apple users — or some other well-known tech company — and may ask you to grant them access to your device, where they’ll then lock you out and prevent you from using it. It’s common for scammers to pose as workers from Amazon, Walmart, or other service providers as well to steal personal and account info.

- Scammers can sometimes pose as a friend on social media or even a match on a dating app.

- Commonly, scammers pretend to sell goods or other services that you’ll never actually get — like concert tickets, pets, property rentals, and other deals that may seem too good to be true.

For those who bank with PNC Bank — and other banks as well — they will not contact you for your online or mobile banking password, your one-time passcode, or ever ask you to send money via Zelle® to reverse or avoid fraud. If you are ever in doubt, contact your bank directly to confirm.

What to Do if You Suspect a Scammer

Always ensure that you know and trust the sender of bank- or payment-related email. It’s always a good idea to avoid clicking on any links or attachments as well as avoiding responding with personal information unless you have know for sure you trust the sender.

If you suspect that you’ve received a fraudulent text, phone call, or e-mail that appears to be from your bank:

- Do not respond

- Do not click on any links

- Do not ever share your banking password

- Do not send money via Zelle® to avoid fraud — most banks would never ask you to do this, so confirm with your bank if you receive this request

- Let your bank know you’ve received this fraudulent message and delete the email or text message.

See More: The History of the Jersey Devil

Limit Payments to People You Know + Trust

It’s important to be on top of Zelle® payments because it’s basically the equivalent of handing someone cash. This fast exchange of money also cannot be canceled once completed. Plus, there’s no protection program in place — meaning if you pay for a service that you don’t get, they won’t pay you back.

Because of this, take extreme caution if you’re going to use Zelle® for an exchange of services or goods with someone you don’t know personally. In fact, PNC recommends avoiding Zelle® entirely for goods and services.

If you responded or gave personal info to a message you’re worried is a scam, contact your bank immediately — and be sure to let Zelle® know about any scam attempts.